The trailer for ‘CRYPTO’ just dropped, and cryptocurrency is good now

With all the exit scams, weird meat obsessions, and cantankerous fan-boy culture, the world of cryptocurrency is kind of a drag. And that’s without even touching on the current and persistent bear market.

But all that has changed, denizens of the internet. Cryptocurrency is good now, and we owe it all to the trailer for the upcoming crypto-themed action flick starring none other than Snake Plissken himself. Say hello toCRYPTO, the film that, like its eponymous subject matter, features a bunch of idiots fighting over bullshit and terrible security practices.

SEE ALSO: One of the most popular Ethereum apps sure looks like a Ponzi scheme

The trailer for the film, featuring an appropriately bedraggled Kurt Russell, hit the internet on March 11 and oh boy did it get our blood flowing. Go ahead and take a peek. We’ll wait.

Breathtaking, right? Did you take a moment to bathe in the reflected glory of Luke Hemsworth and Alexis Bledel. Yes? Good, let’s move on.

The story, as much as there appears to be one, follows an anti-money laundering expert’s trip to small town America and a subsequent run in with the Russian mob. But put that aside for a moment, and let’s focus on the verisimilitude of the thing.

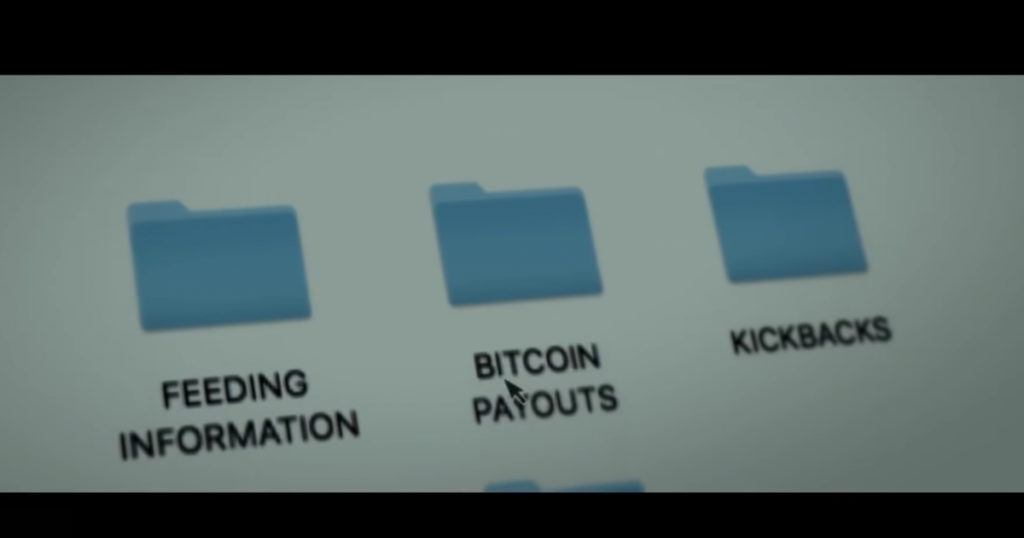

It can only go up.

Image: screenshot / “crypto”

From the amazing file labeling system (hello “KICKBACKS”), to the apparent Coinbase knockoff DELTA COIN listing bitcoin cash at $983.74 (which, LOL),CRYPTOproves that the true cryptocurrency

Be the first to write a comment.