Facebook Announces New Libra Cryptocurrency

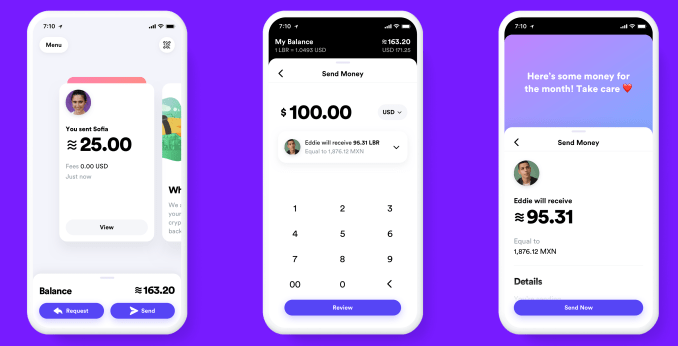

Facebook has finallyrevealed the details of its cryptocurrency, Libra, which will let you buy things or send money to people with nearly zero fees. You’ll pseudonymously buy or cash out your Libra online or at local exchange points like grocery stores, and spend it using interoperable third-party wallet apps or Facebook’s own Calibra wallet that will be built into WhatsApp, Messenger and its own app. Today Facebook released its white paper explaining Libra and its testnet for working out the kinks of its blockchain system before a public launch in the first half of 2020.

Facebookwon’t fully control Libra, but instead get just a single vote in its governance like other founding members of the Libra Association, including Visa, Uber and Andreessen Horowitz, which have invested at least $10 million each into the project’s operations. The association will promote the open-sourced Libra Blockchain and developer platform with its own Move programming language, plus sign up businesses to accept Libra for payment and even give customers discounts or rewards.

Facebook is launching a subsidiary company also called Calibra that handles its crypto dealings and protects users’ privacy by never mingling your Libra payments with your Facebook data so it can’t be used for ad targeting. Your real identity won’t be tied to your publicly visible transactions. But Facebook/Calibra and other founding members of the Libra Associationwill earn interest on the money users cash in that is held in reserve to keep the value of Libra stable.

Facebook’s audacious bid to create a global digital currency that promotes financial inclusion for the unbanked actually has more privacy and decentralization built in than many expected. Instead of trying to dominate Libra’s future or squeeze tons of cash out of it immediately, Facebook is instead playing the long-game by pulling payments into its online domain. Facebook’s VP of blockchain, David Marcus, explained the company’s motive and the tie-in with its core revenue source during a briefing at San Francisco’s historic Mint building. “If more commerce happens, then more small businesses will sell more on and off platform, and they’ll want to buy more ads on the platform so it will be good for our ads business.”

The risk and reward of building the new PayPal

In cryptocurrencies, Facebook saw both a threat and an opportunity. They held the promise of disrupting how things are bought and sold by eliminating transaction fees common with credit cards. That comes dangerously close to Facebook’s ad business that influences what is bought and sold. If a competitor like Google or an upstart built a popular coin and could monitor the transactions, they’d learn what people buy and could muscle in on the billions spent on Facebook marketing. Meanwhile, the 1.7 billion people who lack a bank account might choose whoever offers them a financial services alternative as their online identity provider too. That’s another thing Facebook wants to be.

Yet existing cryptocurrencies like Bitcoin and Ethereum weren’t properly engineered to scale to be a medium of exchange. Their unanchored price was susceptible to huge and unpredictable swings, making it tough for merchants to accept as payment. And cryptocurrencies miss out on much of their potential beyond speculation unless there are enough places that will take them instead of dollars, and the experience of buying and spending them is easy enough for a mainstream audience. But with Facebook’s relationship with 7 million advertisers and 90 million small businesses plus its user experience prowess, it was well-poised to tackle this juggernaut of a problem.

Now Facebook wants to make Libra the evolution of PayPal. It’s hoping Libra will become simpler to set up, more ubiquitous as a payment method, more efficient with fewer fees, more accessible to the unbanked, more flexible thanks to developers and more long-lasting through decentralization.

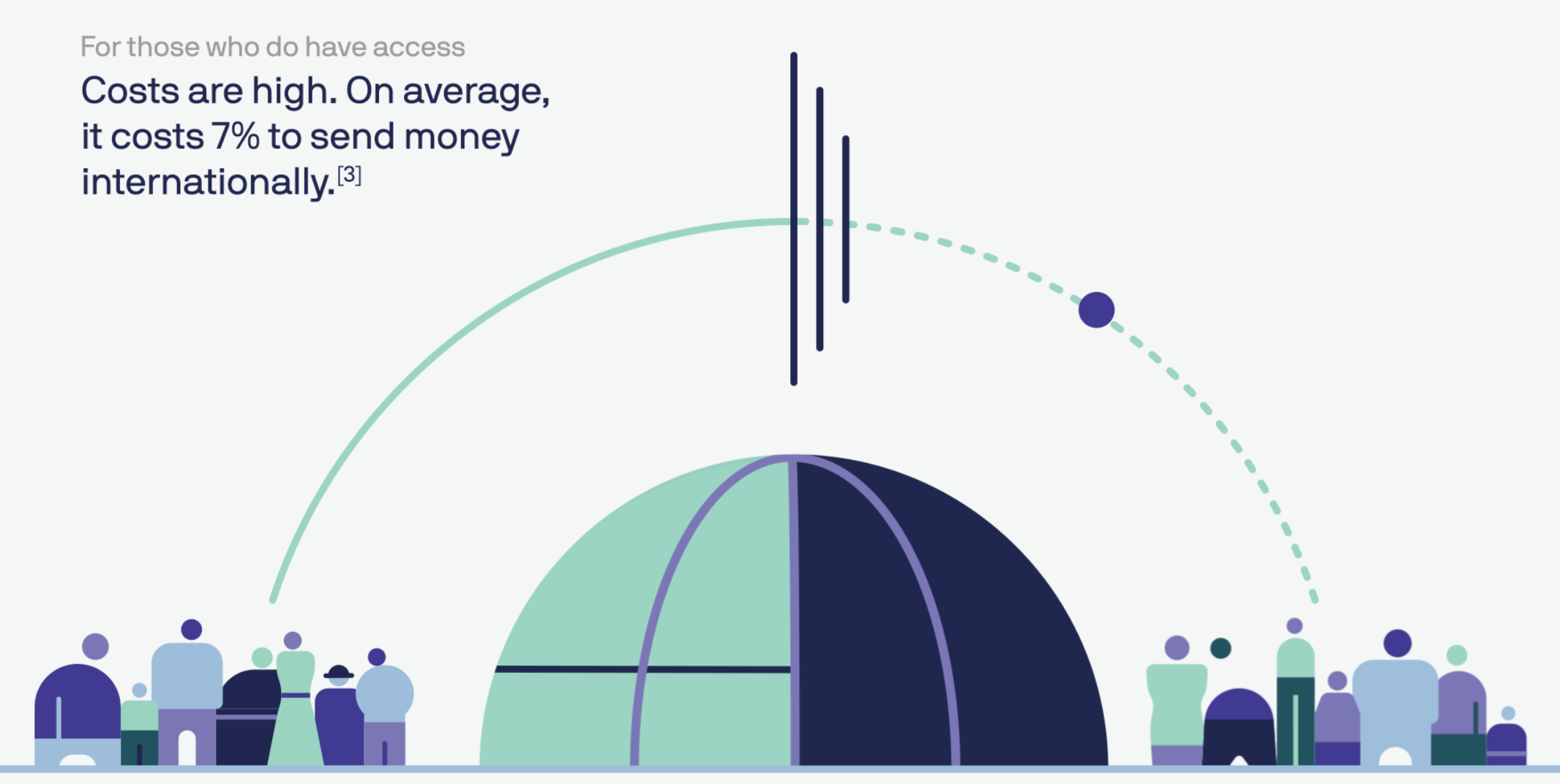

“Success will mean that a person working abroad has a fast and simple way to send money to family back home, and a college student can pay their rent as easily as they can buy a coffee,” Facebook writes in its Libra documentation. That would be a big improvement on today, when you’re stuck paying rent in insecure checks while exploitative remittance services charge an average of 7% to send money abroad, taking $50 billion from users annually. Libra could also power tiny microtransactions worth just a few cents that are infeasible with credit card fees attached, or replace your pre-paid transit pass.

…Or it could be globally ignored by consumers who see it as too much hassle for too little reward, or too unfamiliar and limited in use to pull them into the modern financial landscape. Facebook has built a reputation for over-engineered, underused products. It will need all the help it can get if wants to replace what’s already in our pockets.

Here’s our zero-buzzword breakdown of Libra:

How does Libra work?

By now you know the basics of Libra. Cash in a local currency, get Libra, spend them like dollars without big transaction fees or your real name attached, cash them out whenever you want. Feel free to stop reading and share this article if that’s all you care about. But the underlying technology, the association that governs it, the wallets you’ll use and the way payments work all have a huge amount of fascinating detail to them. Facebook has released more than 100 pages of documentation on Libra and Calibra, and we’ve pulled out the most important facts. Let’s dive in.

The Libra Association — crypto’s new oligarchy

Facebook knew people wouldn’t trust it to wholly steer the cryptocurrency they use, and it also wanted help to spur adoption. So the social network recruited the founding members of the Libra Association, a not-for-profit which oversees the development of the token, the reserve of real-world assets that gives it value and the governance rules of the blockchain. “If we were controlling it, very few people would want to jump on and make it theirs,” says Marcus.

Each founding member paid a minimum of $10 million to join and optionally become a validator node operator (more on that later), gain one vote in the Libra Association council and be entitled to a share (proportionate to their investment) of the dividends from interest earned on the Libra reserve into which users pay fiat currency to receive Libra.

The 28 soon-to-be founding members of the association and their industries, previously reported by The Block’s Frank Chaparro, include:

- Payments: Mastercard, PayPal, PayU (Naspers’ fintech arm), Stripe, Visa

- Tech

Be the first to write a comment.